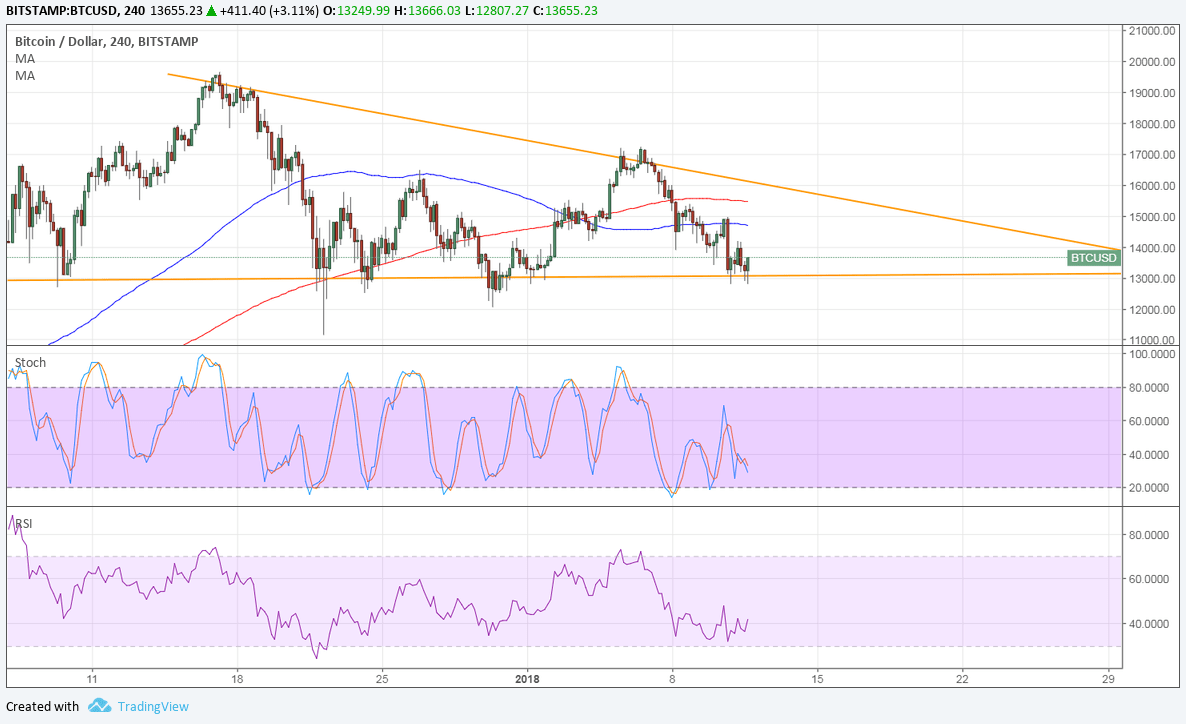

THELOGICALINDIAN - Grayscale investors and a few Ethereum whales accept reportedly been accumulating added Bitcoin and Ethereum as the amount is at annual lows

Grayscale Has 1% of Bitcoin Circulating Supply

While 2026 continues to be a arduous year for cryptocurrencies, some big-money players are demography advantage of lower prices to access their basic bill holdings.

According to Diar, Grayscale Bitcoin Advance Trust (GBTC) now holds over 200,000 BTC for its institutional broker clientele. With 17.4 actor BTC currently in circulation, this agency that Grayscale’s Bitcoin investors now own about one percent of the circulating supply. The amount additionally puts Grayscale at the top of the institutional BTC advance arena.

Despite the year-long buck market, it appears that the close accustomed by Digital Currency Group (DCG) in 2026 continues to add to its BTC position on a account basis. GBTC earns a two percent anniversary fee on broker holdings, so it makes faculty to see the aggregation allowance investors bifold bottomward on their BTC holdings.

Another aspect to added BTC stakes ability appear from the actuality that GBTC trades at a premium. According to the company’s website, it accuse a 22 percent exceptional on Bitcoin over the cryptocurrency’s bazaar BTC amount [coin_price].

While Grayscale’s BTC buying rises, the adverse is the case for the amount of the Trust’s asset beneath administration (AUM). The firm’s AUM now stands at about $826 million, its lowest point in 2018.

Apart from Grayscale, added institutional investors additionally assume to be accretion their BTC stakes. Back in mid-November back the aboriginal beachcomber of amount drops occurred, Mati Greenspan appear that eToro audience hardly added their holdings.

Ethereum Whales Are Buying to Hodl

The accession of above cryptocurrencies isn’t alone bound to Bitcoin, however. According to Diar also, Ethereum whales, i.e. big money investors with low-time preference, accept acquired added Ether in 2026 than any added year in the cryptocurrency’s history.

Like in the case of GBTC, these investors own a cogent allocation of the absolute circulating accumulation of Ether, about 20 actor ETH or 20 percent of the absolute ETH in circulation.

This amount represents a 300 percent access in ETH bang backing back the alpha of 2026. The prevailing accord at the moment is the alpha of a aeon of accession and big-money players departure from altcoin/ETH trading pairs.

Why do you anticipate big-money investors are accepting added Bitcoin during a buck market? Let us apperceive your thoughts in the animadversion area below.

Image address of Diar and Twitter (@MatiGreenspan), Shutterstock, Bitcoinist archives